The Ripple Effect – The XRP Price Movement Explained

How does the price of one cryptocurrency affect others? In this blog post, we will explore how the price of a single cryptocurrency can affect its peers and even other cryptocurrencies. We will go over two key concepts: “ripple effect” and “anchor theory.”

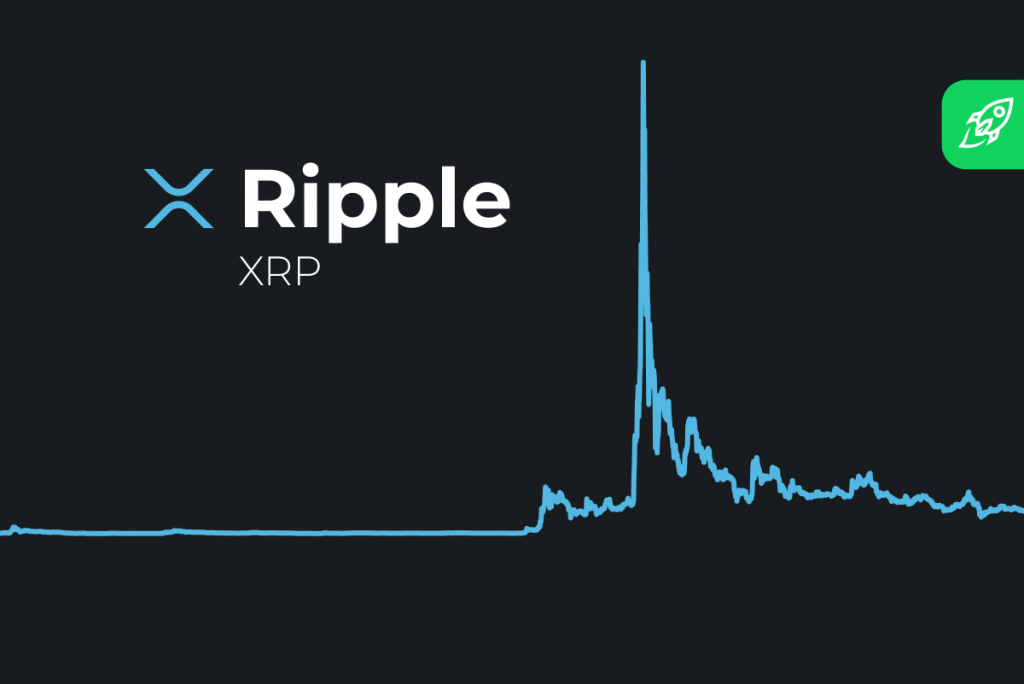

Ripple, the company behind XRP currency, has seen a sharp rise in its stock price since it announced that Bithumb was adding support for trading. This caused many investors to purchase more of the crypto as they anticipated an increase in demand on exchanges where this token is traded.

However, those same announcements have also led to other cryptocurrencies losing value due to uncertainty and speculation over how much traction XRP will get from these listings.

In just three days alone xlc prices have fallen by nearly 30% and xln/xlr are struggling with their own ripple effects too. It’s not clear what exactly will happen but we’re seeing definite patterns emerge.

In recent months there has been a massive movement of XRP from the Ripple company to crypto exchanges. The xrc price has been closely tracking this move and is now starting to rise on some exchanges as a result.

The ripple effect is a concept in economics that refers to the idea of one event causing another event. In this case, it can refer to how an increase or decrease in one cryptocurrency’s price will affect its peers and even other cryptocurrencies. For example, if XRP increases by 200%, then xlm may also increase by 100%.

Anchor theory is a model where new investors are looking at established currencies (i.e., anchor) for pricing information when deciding what currency, they want to buy into. This means that XRP has high visibility as people start buying XRP because there are so many units available on exchanges while others such as xlm have less liquidity and therefore represent more risk for potential buyers.

The XRP Price movement is a result of the high market demand for XRP. When people see that XRP has more units available on exchanges than other currencies, it’s like seeing an “offer” sign and they want to buy XRP because there are so many units available.

So when xlm drops in price by 100%, then for every $1000 you have invested into xlm, your investment will now be worth only $500 instead of $2000. The same applies to any currency pair (i.e., ETH / BTC). If one cryptocurrency rises while another falls, this can also cause prices to move up or down with those two coins until equilibrium between them is found again just as a stock exchange can change prices.

In the XRP price movement, xlm is a relatively minor coin (i.e., it’s not XRP) and has a smaller market cap than XRP does. However, if you want to buy xlm with your investment money from xrc that now costs more because of an increase in the demand for XRPs since release date, then someone else will have to sell their xrx to buy xlms at this higher rate which pushes up the price of both currencies (xlr/xlc).

This means that when one cryptocurrency rises while another falls, there are some cases where people may need to wait out until equilibrium between them is found again just as a stock exchange can change prices.

The xlm price has been rising at a much faster rate than xrc in the last few weeks and it’s not yet clear which way this will go but if xlm is to be XRP’s next big coin (xvc was previously) then there may well come another time when xlr/xln are both trading higher, but for now we’re seeing an ongoing ripple effect between them with xlc being pushed up as people need it for their business needs.

The xlc, xlr, xlm, xbx and xto prices are all down today following recent announcements by Bithumb that it was adding support for trading with XRP. However these same announcements have also led to other cryptocurrencies losing value due to uncertainty or speculation over how much traction xrl will get from these listings

Term: Popularity – Increase in demand

Term: Invest – Purchase more cryptocurrency tokens (XRP)

Term: Rebound effect – Where something falls but then increases again after correcting itself.

I hope this article was helpful for you and you have understood the entire Ripple Movement.